Chambertin ’15: The Grand Cru That Walks Kings to Their Dividends

Domaine Armand Rousseau’s 2015 Chambertin Grand Cru glides through the fine-wine market like a velvet-cloaked entourage - graceful yet unstoppable, with profits still on the horizon.

The Procession in Motion

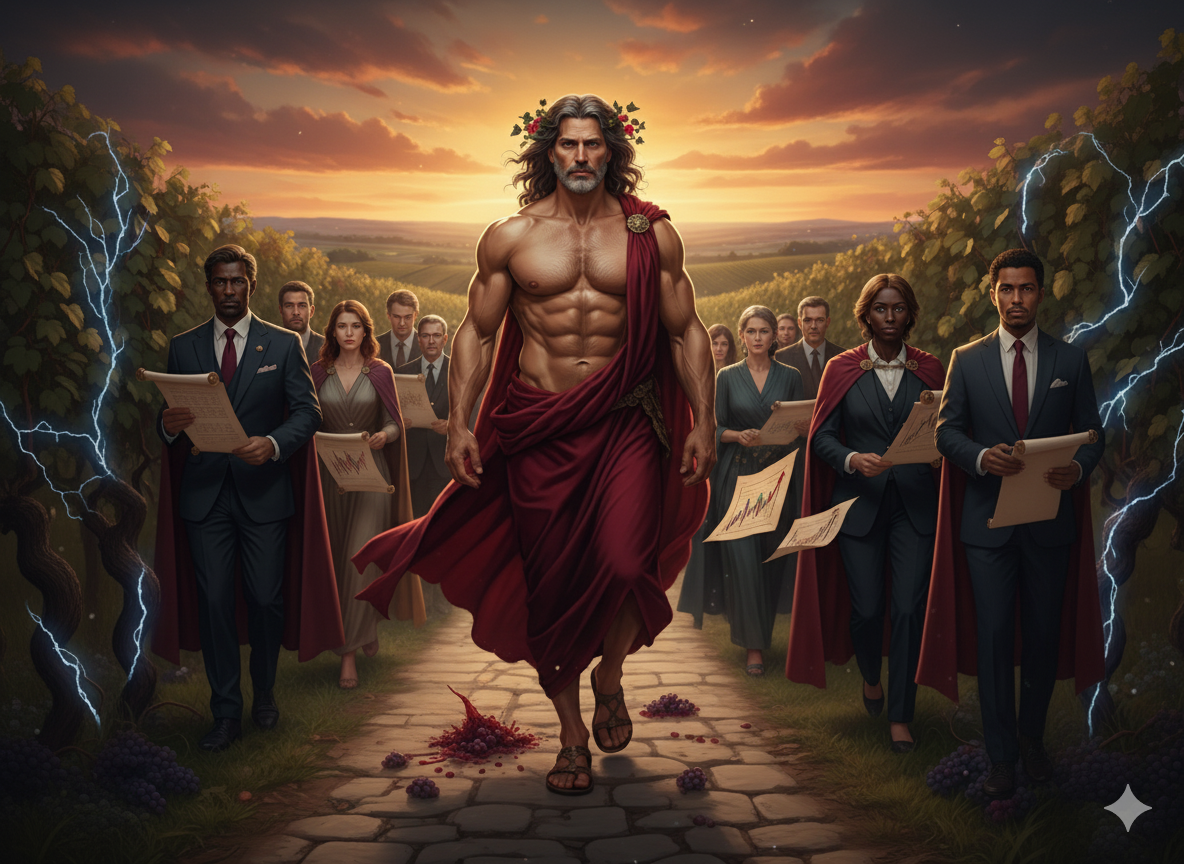

Bacchus sweeps into the courtyard at a brisk, almost theatrical stride, cloak snapping like a mainsail in fresh wind. Flanking him are titled investors - dukes of venture, countesses of crypto, barons of blue-chip equity - keeping pace along the vineyard’s limestone path. Their polished shoes scatter pebbles and the occasional crushed grape; a faint mist of crimson lingers in the air as they descend toward Chambertin’s storied parcels. The march has purpose: convert restless capital into an asset that breathes, ages, and compounds value in silence.

Market Pulse

The first flash of data arrives on a leather folio: a single bottle trades on Liv-ex for $7,869. Five years ago that same bottle fetched $5,308, translating to an annualised climb just shy of 7%. Volatility hums beneath the numbers at 131.9%, and the harshest correction since 2020 lopped 40.04% off earlier peaks. Yet Sotheby’s gavels ring steadily, and bid-ask spreads on the exchange have narrowed each quarter, signalling that the path beneath investors’ boots is evening out.

Vintage Standing

Halfway down the slope an earl wonders aloud if older bottles might serve them better. Bacchus turns, vine wreath swaying, and explains that the revered 2010 commands roughly a quarter more in price for similar critic acclaim, whereas the softer-scored 2012 sits about fifteen percent cheaper but lacks mythic aura. The 2015 therefore occupies a golden midpoint - renowned enough for confidence, youthful enough for further upside.

Provenance: The Asset’s Passport

At a low stone wall the party pauses to examine parchment seals. Each bears the LWIN code, certifying original wooden cases kept under bond at twelve to thirteen degrees Celsius and sixty-five percent relative humidity. Such documentation elevates a romantic farm product to a tradable security fit for sovereign wealth. Without it, even a god cannot guarantee value.

Catalysts on the Horizon

Conversation shifts to tomorrow. Should Burgundy’s benchmark index revive as it has after past setbacks, a mere seven percent lift could nudge this wine to $8400 within a year. Stretch the horizon to two years and dwindling stocks, coupled with the wine’s first true drinking plateau in 2028, could press prices toward $8960. Everyone recognises that supply will tighten precisely when corks begin to yield.

Risk and Balance

Capital near eight-thousand dollars a bottle demands composure. Burgundy sentiment can pivot on a rumour or an early-morning frost. Diversifying with steadier Champagne or Right-Bank Merlot reins in the spirited prance without dulling the thrill of ownership.

Final Velvet Arrival

The procession reaches an archway bathed in twilight. Bacchus raises a hand, and conversation stills. “Invest,” he says, voice warm as barrel toast, “but set aside one bottle for the evening when wealth and wonder share the same cup.” The nobles nod, portfolios already re-weighted in their minds, and follow him into the dimly lit cellar where fortunes quietly ferment.